Understanding What Causes Slippage Tolerance?

In Cryptocurrency Transactions, Slippage Tolerance is affected by 4 Market Conditions:

Network Congestion

If the Blockchain Network you are using gets congested, Slippage Tolerance can occur.

Network Congestions mostly affects Decentralized Finance (DeFi) Exchanges.

All Blockchain Transactions undergo the same process where they first have to be Validated & Confirmed.

When a Network is busy, orders get backlogged in Mempools until they have been Validated & Confirmed by a Validator or Miner.

This is what mainly causes Slippage Tolerance.

High Transaction Volumes

When a market is in High Demand, you will see a lot of Buying & Selling, this creates pressure on the Market Makers & current Liquidity Pools.

While Traditional Market Makers & Automated Trading Systems struggle to keep up with the demand.

The end result is Low Liquidity which causes Slippage Tolerance.

Price Volatility

When a Market is Volatile, Market Prices will start to Rapidly Fluctuate.

This makes it very difficult to execute an order.

From the moment you create the order until the time the order is sent, it is likely that the price will change Invalidating the Transaction.

This could affect the Slippage Tolerance.

Low Liquidity

Low Liquidity is a Main Cause of Slippage Tolerance, 3 Conditions can create Low Liquidity in Cryptocurrency Transactions:

-

- A Limited Amount of Buyers & Sellers

- Limited Order Books for Centralized Cryptocurrency Exchanges

- Limited Liquidity Providers for Decentralized Exchanges (DEXs)

Slippage Tolerance Strategies!

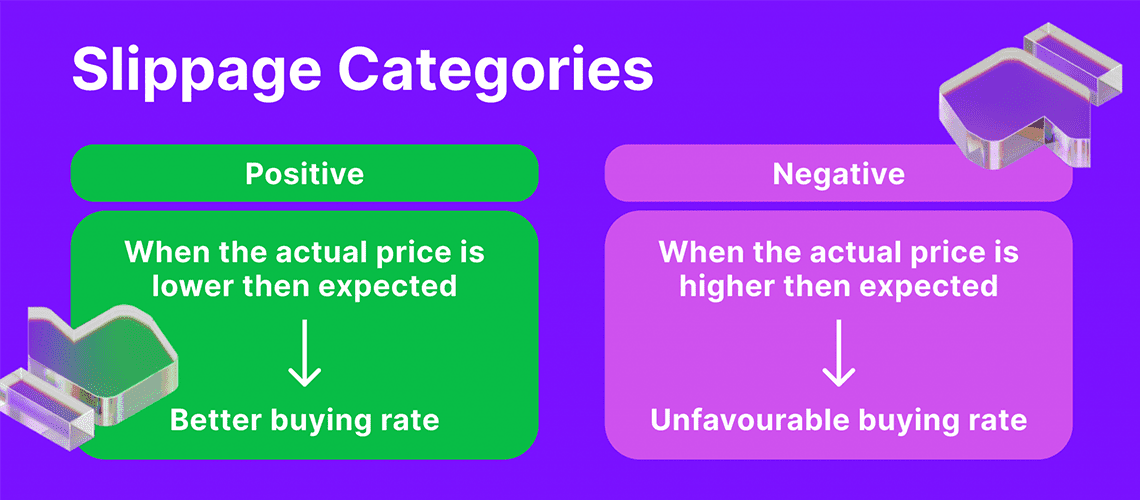

After you Understand the Impact that Slippage Tolerance has on a Transaction, you can then begin to take the Necessary Steps to Limit your Exposure when Buying & Selling Cryptos.

Here are the Main Strategies that can help you Reduce the Slippage Tolerance on your Transactions:

Monitoring Market Conditions

Monitoring market conditions can help your Transactions limit their losses due to Slippage Tolerance.

Start by being Vigilant by watching news reports and Monitoring current Crypto Events that could affect the Markets.

You can amend your orders accordingly to avoid fast-moving price changes to Minimize Potential Losses.

Limit Orders

Limit Orders are one of the most effective ways to reduce Slippage Tolerance.

By placing a limit order, you can select a certain price that you are happy with receiving, which means that the order will only be Executed at your Desired Price.

This Guarantees that you will receive the price that you want, in turn avoiding unnecessary Slippage Tolerance.

Trusted Exchanges

Make sure that you always use a Trusted & Reliable Exchange, this will help you avoid Risky Trades and Limit Losses due to Slippage Tolerance.

Trusted Exchanges are Paramount knowing that you will always have access to High Liquidity, Lower Fees, and Quick Execution on your Transactions.

Automated Systems

Automated Trading Systems are a Smart way to reduce Slippage Tolerance.

These Systems are Designed to Execute your trade based on Predetermined Settings set by you with quick Response Times

They are Designed for their Sophisticated Algorithms that Calculate the best Parameters needed to Minimize Losses due to Slippage Tolerance.

Liquidity

As already stated previously, Liquidity is the Main Cause of Slippage Tolerance which can significantly affect the current price.

The more Liquidity Available the lower Slippage Tolerance will be.