- February 17, 2022

- Posted by: MasterAdmin

- Category: Cryptocurrency

On the surface, it would appear that domaining, the practice of buying and selling web domains for profit, is a low-barrier venture. After all, anyone can purchase web domains for a few bucks each and resell them for thousands of dollars. However, entrants with low investment capital quickly find that identifying potentially valuable names at face value is challenging.

\

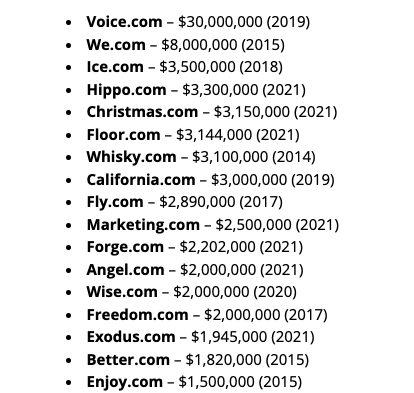

It would be a great deal easier to get started if there were easy access to premium names such as single-word domains, which are effectively the prime real estate of the internet. This makes the path to making money clearer. The image below shows the selling prices of some single-word web domains.

Fractionalization of domain assets or portfolios is perhaps the only way to open up access to premium names. There have been various attempts to fractionalize domain names, most recently in January 2022 when domain broker MediaOptions partnered with alternative asset investment service RallyRD to break Direction.com into 14,000 shares. Each share sold for $10. Per RallyRD’s mode of operation, Direction.com shareholders will be able to trade their positions on Rally’s trading platform after a 90-day holding period. As of writing, RallyRD is only available to United States residents.

\

Then, the challenge is figuring out how to make domain fractionalization happen at scale and globally.

\

Blockchain tokenization via NFTs presents a scalable solution.

How blockchain tokenization of domains works

There are two general ways to think of blockchain-based fractionalization of web domains depending on portfolio size.

\

The first and most straightforward option is to leverage existing asset tokenization platforms to issue fractional tokens. This can be ideal for domain brokers looking to tokenize large portfolios.

The second option is to set up a dedicated tokenization platform for domains. This would be ideal for the tokenization of individual domain names.

Fractionalization using tokenization platforms

Asset tokenization is already a thing, thanks to services like Polymath. In 2020, RedSwan, a blockchain commercial real estate marketplace, partnered with Polymath to tokenize $2.2 billion worth of real estate. The tokenization of domain assets would work similarly since issuance platforms typically have a unified process. For instance, issuing tokens on Polymath begins with the reservation of a ticker symbol, followed by token configuration to enforce governance rules, including total supply, offering jurisdiction, dividend distribution, voting rights, etc., and finally, token distribution to subscribers/investors.

Fractionalization Via Dedicated Domain Tokenization Platform

This involves setting up a dedicated domain tokenization and trading venue for anyone to use. This is what we’re doing at Cloudname. Our platform, currently in beta, allows individual investors to import their domain assets and tokenize them as NFTs, which other investors can then purchase and trade.

\

A purpose-built domain system like Cloudname opens up new possibilities beyond tokenization and trading. We’re incorporating a price discovery engine and research tools that make it possible for domain investors to make smarter investment decisions.

Benefits of blockchain domain fractionalization

Beyond easy access to elite domain assets, domain fractionalization can:

Expand the domain market: fractionalization tends to increase retail participation — as seen in the stock market over the last two years. A 2021 Boston Consulting Group report valued the secondary market for domain trading at roughly $2 billion. That figure would most certainly grow as new investors enter the space.

Liquidity: Blockchain tokenization can also alleviate the liquidity bottlenecks that domainers currently face, thanks to the introduction of fresh capital and the possibility to trade domain tokens or NFTs in real-time.

\

Final word

Looking through popular domain investing forums, it’s apparent that there’s some interest in the fractionalization of domain names because they understand it would be a game-changer for the industry. Still, there are concerns around acceptability, regulations and the governance of domain portfolios.

\

While genuine, these concerns aren’t as significant as imagined. Here’s why.

\

On acceptability: the emergence of blockchain domains such Ethereum Naming Service (ENS) and Handshake has created new types of domain assets. ENS is making crypto wallet addresses human-readable.

\

For instance, ENS can point an address like 0x71C7656EC7ab88b098defB751B7401B5f6d8976F to cloudname.eth. These blockchain domains are changing hands for thousands of dollars on Opensea, an NFT marketplace. The idea of owning a portion of these domain names will only increase the demand for fractional ownership of domains.

\

Regarding regulation, blockchain-based domain trading can work similarly to crypto trading by adhering to KYC/AML stipulations. In addition, most of the government demands that domain fractionalization would pose can be handled by smart contracts. Governance items such as the allocation of voting rights to sales or rental decisions can be irreversibly coded into a smart contract.

\n \n