- February 11, 2022

- Posted by: MasterAdmin

- Category: Cryptocurrency

How to assess which are the most promising cryptocurrency to invest in presents a number of challenges for investors, especially when attempting to approach the matter from the standpoint of risk-reward ratio.

Put simply, how much risk are you willing to take for a given quantum of reward?

Measuring crypto price volatility

So let’s begin with how to measure risk in cryptocurrency. Price volatility is naturally the metric that springs to mind. If prices are prone to swing about erratically there is more risk to your capital.

When it comes to crypto, price volatility can scare off investors more used to the relatively sedate environment of the equity markets, although volatility there may pick up this year due to inflation and the rising risks associated with central bank policy missteps.

However, if an investor takes a longer-term view – say three years – then the risk-reward ratio is not quite as scary as it appears at first glance, or as media coverage might lead you to believe.

Over longer time scales a number of top cryptocurrency stand out, and this will guide our selections below.

Using the Sharpe ratio to analyse crypto assets

We will use a financial metric called the Sharpe ratio to measure how much return has been achieved historically for a given amount of risk. Clearly the Sharpe ratio, like all other financial metrics, cannot predict the future, but it does provide a helpful tool for comparison between different coins and between crypto as a whole and other asset classes.

Next, we want to look at the prospects for future earnings, which is a tough call in traditional asset classes, never mind crypto.

For future earnings, let’s treat crypto like other tech start-ups

Many crypto projects have little earnings to speak of, but in that respect they are arguably no different to a tech stock of a newish company still building its product and market penetration.

In fact investors are increasingly viewing the crypto world and tech stocks as similar, certainly if the price correlation between the two is anything to go by.

When the Nasdaq does well so too does the crypto complex – the two have, over the past few months, shown very high positive correlation, meaning their prices move in the same direction.

So if we should analyse crypto projects in a manner not dissimilar to how we treat tech stocks, then their technology and prospects for securing future market share in their addressable markets are key.

Therefore our selection has a bias towards blockchains that are solving the scaling problem, such as Solana, as well as those already generating profits, namely exchange tokens like BNB; those that make good use of the special characteristics of blockchain tech such as Lucky Block.

Others of our choices are essential to the ecosystem such as Chainlink, or have well-developed technology with a lead in markets that are likely to develop strongly over the near to medium term such as Decentraland and its NFT-powered metaverse technology.

With the exception of our first selection, Lucky Block, which is a brand new coin, we used a screener, to find crypto with the best 3 year Sharpe ration and a reported market capitalisation of $5 billion of greater.

So what is the Sharpe Ratio?

Invented by Nobel prize winning economists William Sharpe, the Sharpe ratio is a measure of risk-adjusted returns. So it analyses returns based on the amount of risk that was taken to achieve the given return.

Sharpe ratio assumes that the best assets are those that combine lower risk with high returns.

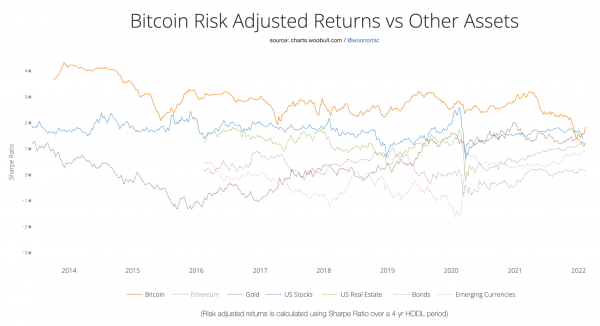

Using his version of the Sharpe ratio to measure risk-adjusted return, crypto analyst Willy Woo has shown that bitcoin – the oldest of all crypto assets – beats all other assets, including stocks and government bonds. This is a good illustration of our earlier contention that investing in crypto – or specifically, investing in bitcoin – is actually not as risky as common narratives suggest.

Bitcoin returns are less risky on a risk-adjusted basis over 4-year periods than other major asset classes

The ratio is determined by comparing the returns from an asset or portfolio of assets with the return from risk-free assets such as US Treasuries, and then dividing that product by the standard deviation of returns:

Sharpe Ratio = (Rp – Rf) / σp

p The particular portfolio of financial assets Rp The return expected from the portfolio Rf The risk-free rate of return σp The portfolio’s risk – the variance (sigma) is expressed as the standard deviation of returns

We ran the numbers through a crypto screener, sorting for those with the best Sharpe ratio over three years.

Crypto asset Ticker Price (USD) Current Market Cap ATH (USD) % Down from ATH Sharpe Ratio (3 years) Solana SOL 106.05 US$33,677,407,907 259 38 2.46 Polygon MATIC 1.88 US$14,074,253,155 2.9049 3 2.00 Avalanche AVAX 90.88 US$22,290,019,055 146 44 1.92 NEAR Protocol NEAR 11.86 US$7,521,143,487 20.39 4 1.87 Terra LUNA 53.95 US$21,710,126,319 103 5 1.86 Fantom FTM 2.14 US$5,443,126,540 3.4708 63 1.68 BNB BNB 415.57 US$68,581,281,864 690 30 1.63 Decentraland MANA 3.20 US$5,858,671,840 5.84 46 1.59 Chainlink LINK 17.66 US$8,245,958,401 52.68 50 1.53 FTX Token FTT 45.17 US$6,228,183,754 85 33 1.48 Ethereum ETH 3109.89 US$371,429,419,830 4848 21 1.47 Crypto.com Chain CRO 0.52 US$13,128,401,387 0.9594 44 1.46

In the table above we find three exchange tokens. This is not too surprisingly because it is one of the best current use cases of a crypto token – to provide discounted fees to exchange users. However we have decided to exclude the exchange coin with the lowest market cap, namely FTX Token.

That leaves us with a total of 12 coins in all, including a new coin that does not feature in the Sharpe ratio table, Lucky Block.

With our parameters now set and results arrived at, let’s walk through the 12 most promising cryptocurrency to invest in 2022.

1. Lucky Block – lottery platform disrupter

Lucky Block started trading on public markets a little over two weeks ago and already commands a valuation of more than $700 million. Lucky Block is building a global lottery system that will be fairer and more transparent than the offering from traditional incumbents.

Crypto has seen plenty of gambling products over the years – betting decentralised apps predated the DeFi explosion as among the first to take off. But as far as lottery products goes Lucky Block is the first of a kind in a number of ways.

For one thing, the jackpot is divided in a unique way, so that 70% goes to winners, but 10% is distributed to all token holders, 10% to charity and 10% back to Lucky Block for marketing and development.

Then there’s the Lucky Block transaction fee. Every time the token is sold on a decentralised exchange, a fee of 12% is incurred, of which 4% goes to the lottery pool, 4% to the liquidity pool, 3% to a NFT and gaming royalty fund and 1% burn.

The token is currently priced at around $0.005, having made its listing debut on a centralised exchange, LBank, for the first time today.

Token distribution for all token holders provides income stream

To receive the token distribution, token holders must hold in a DEX wallet such as Trust Wallet or Metamask. Trust Wallet is probably the better pick because Lucky Block is built on the Binance Smart Chain and Trust Wallet is a Binance product, hence the better integration with swaps on the chain.

The Lucky Block app is where tickets for the $5 tickets for the daily lotteries will be bought from 21 March, assuming the team delivers on the announced scheduled. The first draw is on 25 March.

Lucky Block is an excellent example of a Web 3.0 product that has significant disruptive potential. Although it doesn’t have a Sharpe ratio because it only started trading two weeks ago, we think the risk-reward potential at these prices is strong. The world wide lottery market is valued at around $330 billion according to QY Research Group.

Buy Lucky Block (LBLOCK) Now 2. Solana (SOL) – Layer 1 blockchain seen as an “Ethereum killer”

Solana is a decentralised Layer 1 blockchain that is highly scalable with transaction per second of up to 50,000. However, it is still experiencing teething problems that have led to a number of outages. Nevertheless its technology is gathering plentiful support.

The Pyth trading network supported by institutional trading houses in Chicago and New York is perhaps the most high profile success of the project. Its NFT and DeFi networks are expanding at pace too.

If you are still needing more information on how to buy cryptocurrency, then check out our guide.

Buy Solana on eToro Now 3. Polygon (MATIC) – Layer 2 blockchain for Ethereum

Polygon is designed to solve the problem of Ethereum’s lack of scalability in its current form. Its core is a composable modular system that makes it highly flexible. As such its Polygon SDK has become a favourite of blockchain developers.

It is a Layer-2 solution that has birthed infrastructures such as Plasma, Optimistic Rollups, zkRollups, and Validium as well as sidechains such as its Matic platform, that is the project’s native token..

Buy Polygon MATIC on eToro Now 4. Avalanche (AVAX) – DeFi and enterprise blockchain base layer

Avalanche is another platform for launching DeFi applications and enterprise blockchain deployments in an environment of interoperability with a view to scalability.

Developers can get up to speed relatively quickly because of its composable approach to creating applications and custom blockchains. The protocol went from strength to strength in 2021, leaping into the ranks of the top coins.

Buy Crypto on eToro Now 5. NEAR (NEAR) – using scalable sharding to solve scalability

NEAR uses a Proof-of-Stake consensus mechanism that features a sharding architecture to scale transaction throughput. Sharding can be though of a system that splits up the blockchain into distincy but connected parts to increase the efficiency of transaction processing.

As NEAR explains, it PoS sharding is unique in that it can “scale linearly with the number of shards, thereby having the ability to satisfy the demand for transactions as more and more users start to use NEAR”.

Buy Crypto on eToro Now 6. Terra (LUNA) – stablecoins to revolutionise payments

Terra is an algorithmically-governed, seigniorage stablecoin platform. Connected to it is a collection of fiat-pegged tokens and a stabilising asset called Luna.

Terraforma Labs in the South Korean company that developed the protocol. It has struck deals with a number of e-commerce partners in Asia to use its system, which aims at nothing less than the eradication of high costs and unnecessary friction in the payments system.

Buy Crypto on eToro Now 7. Fantom (FTM) – an under the radar Layer 1 blockchain

Fantom is another Layer-1 blockchain, but hasn’t yet received the same sort of attention as Solana. It uses a single consensus layer to underpin multiple possible execution chains.

The end goal of the project is the fashioning of an ecosystem of execution layers aimed at catering for a multitude of use cases, all the while enabling scalable and cheap transactions on its novel Lachesis Protocol.

Buy Crypto on eToro Now 8. Binance Coin (BNB) – coin of the world’s largest crypto exchange

Binance Coin is the native token of the Binance online exchange. It started llife as a way of providing exchange customers with cheap trading fees. Binance is today the largeset crypto exchange.

But is is also much more than an exchange having launched the Binance Smart Chain and the Smart Chain token which is a wrapped version of BNB. BSC is a fast-growing environment for decentralised applications.

If you want to delve a little deeper into which are the best crypto exchanges, read our guide to finding the one that fits your needs.

Buy Crypto on Binance 9. Decentraland (MANA) – NFT and metaverse pioneers

Decentraland is a decentralised, explorable, 3-D virtual reality platform, but without the need for VR goggles. It is built on the Ethereum blockchain.

The platform allows its users to take ownership of parcels of digital land, purchased with LAND tokens bought with the MANA native token. Users leverage NFT tech to create their own distinctive unique environments in a virtual world. Brands, companies and individuals have started flocking to its metaverse world.

Buy MANA on eToro Now 10. Chainlink (LINK) – secure oracle network essential for smart contracts

Chainlink is a decentralised oracle network that provides secure off-chain data feeds for smart contracts.

As such Chainlink could be described as essential middleware that brings smart contracts to life by allowing them to securely interact with external data and the changes in that data.

Buy Chainlink on eToro Now 11. Ethereum (ETH) – the king of decentralised application platforms

Ethereum is a distributed blockchain computing platform upon which smart contracts and decentralised applications (dapps) can be run. Its native token is ether (ETH). Its Ethereum Virtual Machine distributed computer means it can host applications and new coins supporting its ERC-20 standard can be layered on top of it.

The network is currently undergoing a major upgrade from proof of work to proof of stake, also known as Ethereum 2.0. Ethereum is the leading base platform of the DeFi sector.

Buy Ethereum on eToro Now 12. Crypto.com (CRO) – exchange, NFT marketplace and emergent smart contract platform

Formerly named Monaco and known for being among the first projects to introduce a crypto-linked Visa card. It has since rebranded as Crypto.com. Crypto.com Chain utilises Tendermint Core as its consensus engine.

The total supply of 100 billion has been issued, with 50% allocated to incentivising those providing services to the network to secure its integrity and transaction throughput.

Crypto.com has recently moved into the burgeoning NFT space. Crypto.com marketing is solid. Recently did a sponsorship deal with the famous Staples Center in Los Angeles, now rebranded as the Crypto.com Arena.